Let's Connect - (423) 454-2525

INVESTORS

Are you interested in entering the Real Estate Market to Generate Substantial Returns on your Hard-Earned Money?

Are you interested in entering the Real Estate Market to Generate Substantial Returns on your Hard-Earned Money?

If you'd like to learn more about Pine View Homebuyers, including our projects, investment opportunities, and ways to collaborate on deals or purchase wholesale properties — we’d love to connect.

Whether you’re seeking a secure alternative to traditional stock market investing or simply want to understand how our private-lending model works, just complete the brief information form below or contact us directly at (423) 454-2525 . We’ll be happy to share details about the available options.

Once we receive your inquiry, we’ll reach out to learn more about your goals, walk you through how we operate, and explore whether our approach aligns with what you’re looking for.

This communication is not a solicitation or offer of securities. Investment opportunities with Pine View Homebuyers are available only to qualified investors and are governed by a written Investment Agreement or Private Placement Memorandum.

Interested In Learning More? Submit Your Info Below or give us a call today at (423) 454-2525.

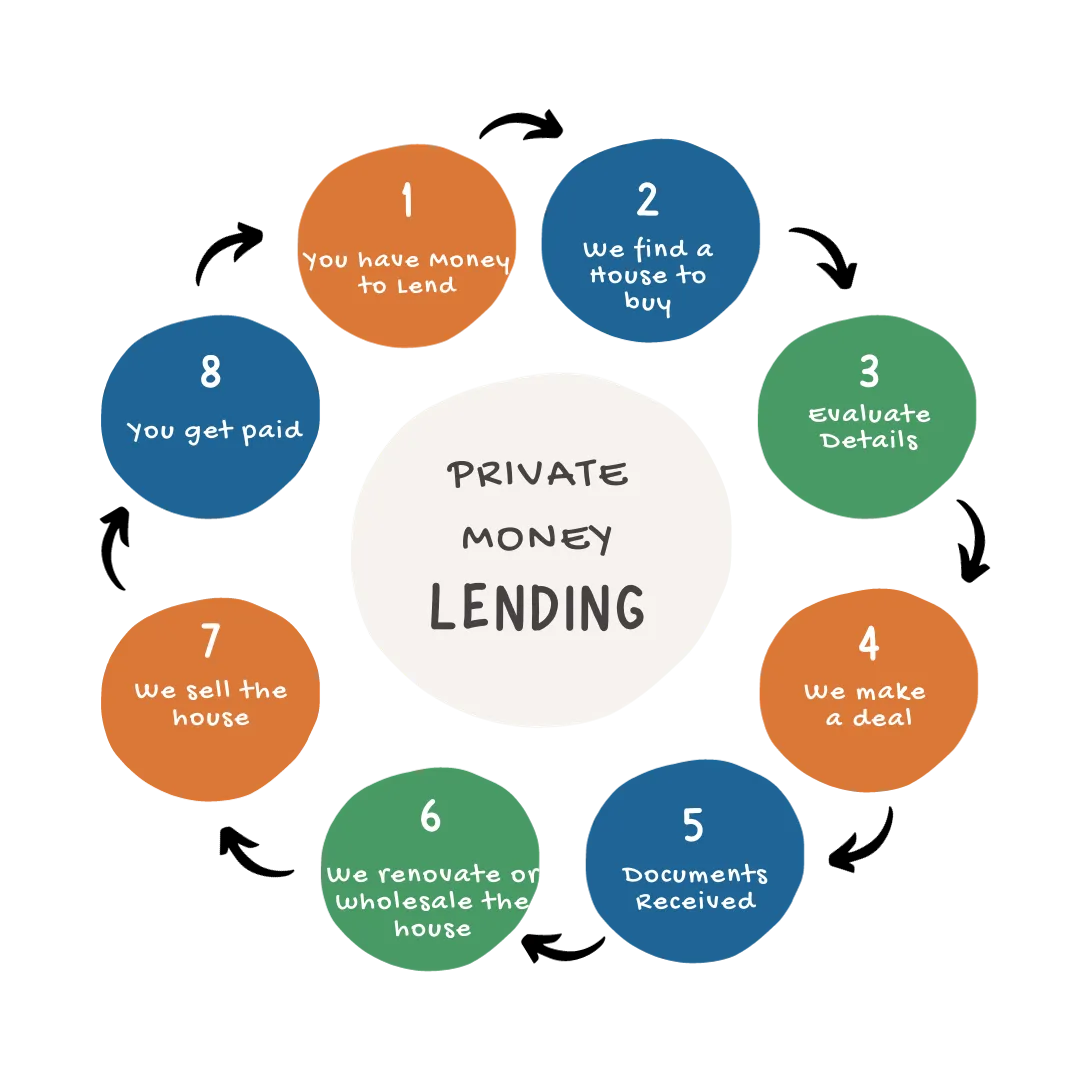

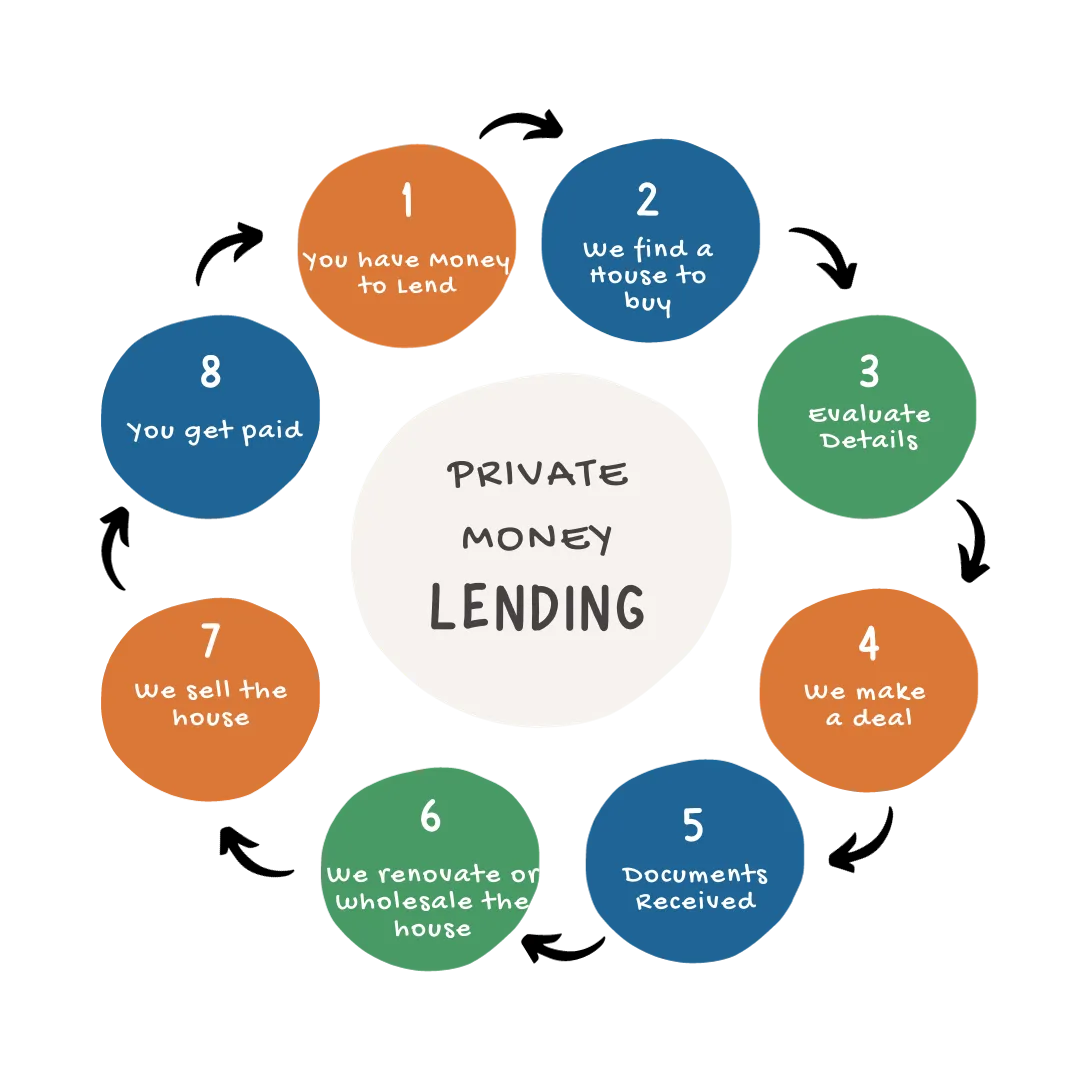

What Is Private Money Lending?

What Is Private Money Lending?

A private money loan refers to a loan provided to a real estate investor, with the real estate serving as collateral. Private money investors are granted a first or second mortgage, which secures their legal stake in the property and protects their investment. Whenever we identify a property significantly below market value, we offer our private lenders the chance to finance the purchase and renovation of the property. This allows the lender to earn remarkably high interest rates, surpassing those attainable through bank CDs and other conventional investment schemes by four or five times.

In essence, private money lending offers you the chance to assume the role of a bank, enjoying the same profits that banks typically do. It presents an excellent avenue for generating cash flow and establishing a reliable income stream. Moreover, it offers outstanding security and safety for your principal investment. By engaging in private money lending, you can engage in a strategy that has long been employed by banks, earning profitable returns on investments supported by real estate. It is a unique investment opportunity that stands apart from any other vehicle.

How Are Investors Protected?

Imagine placing yourself in the role of a bank by directing your investment capital, including retirement funds, towards securely backed real estate mortgages. Mortgages offer utmost safety since, in the event of default, the bank (in this case, you) can recoup the investment as the primary lien holder on the property.

Before purchasing any property, each one undergoes a thorough evaluation process to assess its profitability. Our aim is to make prudent investment choices, ensuring sound decision-making. To safeguard your interests, we provide you with the following protections:

Mortgage or deed of trust is recorded at the courthouse

Fire and hazard insurance on property

To guarantee the property's legal ownership, we perform a comprehensive title search to ensure its freedom from encumbrances. For rental investments with long-term financing, we always maintain hazard insurance on the property. As a mortgagee, you will be listed, and we will notify you promptly if the insurance is not kept up to date. In the event of any property damage, insurance proceeds would be utilized for property rebuilding, repairs, or repayment to you.

The Private Lender Process

OUR

APPROACH

Our strategy involves acquiring distressed properties that are significantly below their market value, often ranging from 35% to 55% below the After Renovation Value (ARV). These properties undergo renovation in some cases and are subsequently sold to retail buyers and landlords. In other instances, they are wholesaled to other rehabbers, investors, and wholesalers.

Our Due

Diligence

Our team adheres to rigorous guidelines to guarantee that the properties we acquire generate excellent returns for both our company and investors. Each property we identify undergoes an extensive due diligence process, meticulously evaluating various criteria, such as:

Location - Every property acquisition shall find its place amidst thriving market hubs, where the currents of high purchase volumes flow abundantly.

School District - We deeply recognize the significance of a school district in the decision-making process when buyers have children, acknowledging its pivotal role in shaping their educational journey.

CMA - Our team conducts a comprehensive Comparative Market Analysis (CMA), ensuring a thorough evaluation of market dynamics and trends.

Purchase Price based Upon % of ARV [After Repair Value]

Condition - The holistic assessment of the property encompasses its overall condition, encompassing the evaluation of mechanical systems, structural integrity, and more.

How Pine View Homebuyers Buys Real Estate:

Equity is inherent in our home purchase approach, where we acquire properties at a substantial discount, ranging from 30-70% below retail value. This instant equity upon purchase results from eliminating intermediaries, such as commissions, mortgage broker fees, loan fees, and reduced attorney costs due to streamlined review processes in typical transactions.

Thanks to our strategic buying approach, we have the capability to present our buyers with fully renovated homes priced at or below the prevailing market rates in the neighborhood. We are selective in our choices, rejecting numerous "close" deals that fail to meet our specific buying criteria. We firmly believe in purchasing properties that make sense for all parties involved.

Think About It...

Do you want to make extra money?

Do you have under performing investments?

Do you invest in the stock market?

Do you have cash?

Do you have interest in real estate but don’t want the hassle?

Four Easy Steps to Invest

A private money loan is a real estate–backed loan provided by an individual investor rather than a traditional bank. The property itself serves as collateral, and the lender’s position is secured with a first or second mortgage, giving legal protection and peace of mind.

Whenever we identify a property priced significantly below market value, we invite our private lenders to fund the purchase and renovation. In return, they earn exceptional fixed returns — often four to five times higher than what banks pay through CDs or other conventional investments.

In essence, private money lending allows you to be the bank — earning steady, predictable income that’s secured by real estate you can actually see and touch. It’s a proven way to create consistent cash flow, build long-term wealth, and diversify your portfolio with a safe, tangible asset.

For generations, banks have built fortunes using this same principle — lending money backed by property. Private lending lets you follow that same blueprint, but with control, transparency, and returns that truly make sense.

How Are Investors Protected?

Imagine stepping into the role of a bank—directing your investment capital, including retirement funds, into real estate loans that are securely backed by tangible assets. Each investment is protected by a recorded mortgage or deed of trust, giving you a first-position lien on the property. In the unlikely event of default, your position as the primary lienholder ensures that your investment can be recovered through the property itself.

Before we ever purchase a property, it undergoes a thorough evaluation to confirm profitability and a comprehensive title search to verify clean ownership and freedom from encumbrances. We believe in making prudent, well-analyzed investments that protect and grow our lenders’ capital.

Every property financed through our private lenders carries fire and hazard insurance for full protection. As the mortgagee, your name is listed on the policy, and you’ll be notified immediately if coverage lapses or claims arise. In the event of property damage, insurance proceeds are used to repair, rebuild, or repay the note, ensuring your investment remains secure.

At Pine View Homebuyers, integrity and transparency guide every step of the process. Our goal is to make private lending a safe, straightforward, and rewarding experience—one that builds steady income and long-term confidence for each of our valued partners.

Define your investment goals: Amount, Time Frame, Payment Terms.

Position you funds for availability

Receive details of investment opportunity

The Private Lender Process

Wire funds for closing

Investment Process

Our investment process is straightforward. We begin by identifying an exceptionally undervalued property that we intend to purchase. Upon your approval, we will secure the necessary funds from you to acquire and renovate the property. During the closing, you will receive important documents, including a mortgage on the home. The subsequent step involves renovating the property, which typically takes around 3-6 months, depending on the project's scale. Once the renovations are finished, we will list and sell the property. When the closing takes place, you will receive your principal amount along with a 10% interest payment. It truly is that simple! Our aim is to consistently generate substantial profits for you by reinvesting your funds and fostering a long-term, mutually beneficial relationship.

Over time, we have built a strong reputation and forged valuable relationships with a wide range of entities, including local and national banks with REO departments, asset management companies and groups, auction houses, probate and divorce attorneys, as well as an extensive network of investors who may be considering retiring and seeking to liquidate their assets.

OUR

APPROACH

Our investment strategy focuses on acquiring distressed or undervalued properties at substantial discounts—typically 35% to 55% below their After Repair Value (ARV).

Each property is carefully evaluated to determine the most effective exit strategy. Some are renovated and resold to retail buyers or long-term landlords, creating beautiful, move-in-ready homes that strengthen local communities. Others are wholesaled to qualified rehabbers and investors, allowing us to maintain steady deal flow and consistent returns for our partners.

This disciplined approach—rooted in accurate valuations, proven systems, and years of experience—ensures that every property we purchase offers built-in equity, reduced risk, and multiple profitable exit options.

Our team follows a disciplined acquisition process designed to ensure every property we purchase delivers strong, reliable returns for both our company and our valued investors.

Before any investment is made, each property undergoes a comprehensive due diligence review, where we carefully analyze multiple factors to confirm profitability and minimize risk. This process includes a detailed evaluation of:

Location

We focus on properties located in strong, active markets with consistent buyer demand and healthy appreciation potential. Each acquisition is strategically positioned within areas that demonstrate high purchase volumes, stable growth, and long-term investment viability.

School District

We understand the vital role that school districts play in home-buying decisions, particularly for families. Our acquisitions often target neighborhoods within desirable or improving districts, ensuring strong resale appeal and lasting value.

Comparative Market Analysis (CMA)

Before any purchase, our team performs a comprehensive Comparative Market Analysis to evaluate current market trends, neighborhood performance, and accurate property values. This analysis ensures every investment is rooted in real data and priced appropriately for maximum return.

Purchase Price and ARV

Each property’s purchase price is based on a targeted percentage of its After Repair Value (ARV). By maintaining disciplined buying standards—typically acquiring properties well below market value—we create built-in equity and reduce risk from the outset.

Property Condition

Every property undergoes a detailed condition assessment, including mechanical systems, structural integrity, roof, foundation, and overall livability. This holistic evaluation helps us determine the most effective renovation strategy or exit plan for optimal results.

OUR DUE

DILIGENCE

How Pine View Homebuyers Buys Real Estate:

Equity is built into every property we purchase. By acquiring homes at 30% to 70% below retail value, we create instant equity from the moment of purchase. This advantage is achieved by eliminating unnecessary intermediaries—such as agent commissions, mortgage broker fees, and traditional loan costs—while streamlining the closing process to reduce legal expenses and delays..

Because of this strategic approach, we’re able to offer our buyers fully renovated homes that are often priced at or below comparable market values within their neighborhoods. We take pride in being highly selective, passing on deals that don’t meet our strict buying criteria. Our commitment is simple: we only purchase properties that make financial sense and create win-win outcomes for everyone involved—our buyers, our investors, and the communities we serve.

If you would like to explore further information regarding Pine View Homebuyers, including our operations and investment opportunities as partners on properties or the purchase of wholesale properties, kindly click the button to schedule a call below. We would be happy to provide you with details about the various options we offer.

Think About It...

Do you want to make extra money?

Do you have under performing investments?

Do you invest in the stock market?

Do you have cash?

Do you have interest in real estate but don’t want the hassle?

Four Easy Steps to Invest

Define your investment goals: Amount, Time Frame, Payment Terms.

Position you funds for availability

Receive details of investment opportunity